Share market experts rely on two analysis before selecting a share for investment. One is technical analysis, in which a share's movement of price and volume is studied over years and they try to strategize the movement. Another is the fundamental analysis in which they study about the company associated with that share, its sector growth etc.

However a genuine investor cares more about fundamental analysis of a company because the price of a share can be manipulated to go up or down. if this there on one side ,as I already said nowadays information about company and sector performance reaches all at the same time through media ,fundamental analysis also became a more common feature known to all experts.

So sometimes, a common man who is a regular observer of market is able to set good portfolio for himself when compared with experts. In this article I will just take you through certain basics of technical analysis.

Candlestick representation of a stock price movement within a day:

A share when traded will be subjected to four price levels:

- Opening Price: The price at which the first trade is done or the market opens

- Closing Price: The price at which last trade is done or When the market closes.

- Intra-Day High: The maximum price the share was traded for the day.

- Intra-Day Low: The minimum price the share was traded for the day.

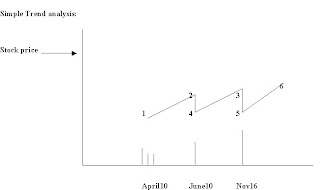

This is simple ideal graph by which I am trying to explain you all the simplest way of predicting and investing. The share price is plotted for various days in a graph as shown above. Using statistical tools the trend line is derived. It will be observed that prices follow a particular pattern. Assume that you are close to level 4 of the graph. Since you know the price is going to rise after that you can buy the stock. The bottom vertical projections from x –axis indicate the volume of trade, usually at these points volume will be more because of buying. Similarly it is the reverse when you are point 3.this is the simplest way of understanding and in further articles I will take you to depth.

Prabhu.s

KIAMS

16 comments:

Hi,

You are right with the fact that there is no layman site for how to start investing in stock markets. Thx for taking this initiative, and I hope you'll keep posting and not lose inspiration. I have bookmarked your blog and will be checking for regular updates.. just to let you know that your time invested in writing these articles here is surely making a difference. phalgun78@gmail.com

Thx for this blog. ur right, theres no site for a layman wanting to begin investing in equity. Your initiative is commendable and I hope you dont lose steam and stop writing. I have bookmarked your blog and hope you will be posting on regular basis.

dear phalgun

i am in engaged in some other work till june 20.after that i will be posting articles.

thanks for your valuable inputs.

pls forward suggestions

prabhu.s

you rocks ; pls keep writing ;

AMAR

thanks amar .pls do share your opinion and be a regular visitor

Hi Prabhu,

Looks like u r an expert in market details.I would like to know somthin about the "sensex, wat do we mean when we say 'sensex has crossed 1000 points',how the graph is obtained etc .If you have the time,Please write bout this.

Got ur blog when i was doin a search in google.

Shimna

Hi Prabhu,

Looks like u r an expert in market details.I would like to know about "sensex,wat we mean when we say sensex has crossed some points,how we get the graph etc" . Please write about it if you have time.Or if it already exists ,pls do lemme know.

Shimna

Hi Prabhu,

Looks like u r an expert in market details.I would like to know about sensex,its graph,its impication etc.If you have time ,please write bout it.Or if it is already written,pls inform me.

Shimna

i m sorry.I published my comment many times thinking that there is some issue .thn i found that u need to approve for it to come :)

Shimna

hi shimna

i will explain about what do you mean about sensex and others in the upcoming articles.thanks .pls do visit frequently

Hi Prabhu,

Thanks for this article, I have just started doing online share trading with Apollo Sindhoori. I was looking for basics on Share Market and your article helped me a lot.

Can you also post on risks involved while doing online stock trading and work around etc...

hi shyam

i will do it shortly for u.be a regular visitor and pass comments.

since ur writings are easy to understand Please explain the following statement"Price band:Rs 44 to Rs 52 Per Equity share of face value Rs 10 each.The face value of equity shares is Rs 10 each.The floor price is 4.4 times of the face value and the cap price is 5.2 times of the face value"

floor price is the minimum price that an investor can quote while buying the share.the cap price is the maximum price beyond which he cant quote while applying for ipo.(intial public offering).face value of the share is the value which is obtained by estimating the capital that is required and forecasting that this much number of people will buy it.generally a compnay wants to raise a capital of say 100 rupees and it expects 10 people will buy.then face value is rs.10.generally face value for most of the shares during its issue will be 10.some have rupees 1 and 5 also.the dividend is issued only on the face value of the share.that is when i sy my didivend yield is fifty percentage i get rs 5 as dividend for a share whose face value is 10 rupees.the diference between the cap price and the floor price is the range and it is also called as price band

Hi Mr Prabhu,

Your knowledge in the share market is simply awesome,can you expalin more about the derivatvies such as future and option and how the profit or loss will be effect in the permium.and tell the difference in datils.

Thanks

Vinoth

Hi Mr Prabhu,

Your knowledge in the share market is simply awesome,can you expalin more about the derivatvies such as future and option and how the profit or loss will be effect in the permium.and tell the difference in datils.

Thanks

Post a Comment